- 5.0 (1 Rating)

- 1 Reviews

Course Overview

- The first time any university is offering this Diploma in Bangladesh.

- Graduates from any discipline can pursue this program.

- Opportunity for graduates of Islamic religious institutions to develop as Shariah Auditor/Advisor

- Curricula are developed by experienced faculty members and professionals.

- Courses are taught by academicians and professionals in Islamic Banking & Finance.

- The convenient program duration is 24 weeks.

- Friday classes (Online).

- Flexible payment mode.

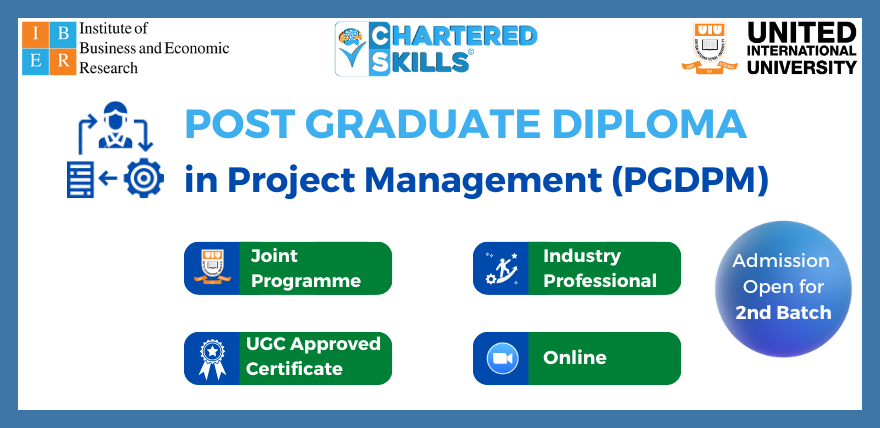

This diploma course is jointly organized by IBER of United International University & Chartered Skills.

The Islamic financial services industry has witnessed prolific growth as a viable sub-sector in the global financial arena thanks to its asset-backed, resilience, and inclusiveness features over the last five decades. Today, Islamic banking, the dominating segment of the Islamic financial services industry has emerged as a strong financial service industry not only in the Muslim majority Middle Eastern, Southeast, and South Asian countries but also in Muslim minority countries such as the UK, Germany, France, Ireland, the USA, Russia, China, Hongkong, Singapore, Thailand, and the Philippines. In tandem with global progress, Bangladesh as one of South Asia's booming economies has also experienced robust growth in Islamic banking & finance due to policy support of the Central Bank and rising public demand.

The Post Graduate Diploma in Islamic Banking & Finance (PGDIBF) is the first of its kind in Bangladesh with the intent to disseminate proper knowledge and expertise on Islamic banking and finance among the fresh graduates to prepare them to enter into the rising local and global Islamic banking industry. In addition, it aims to update the knowledge of Islamic finance professionals who are seeking to sharpen their understanding of principles, instruments, operating procedures, and legal, regulatory, and Shariah framework of Islamic banking and finance.

The Post Graduate Diploma in Islamic Banking & Finance (PGDIBF) would also offer a great opportunity for graduates of Islamic religious institutions to develop as Shariah Auditor/Advisor who can work in Islamic banking and Sukuk Issuing non- banking firms. This diploma is going to offer compact study materials to get acquainted with the ideal Islamic banking and finance products including Sukuk and operating procedures to meet the aspiration of rising local and foreign interest and concerns in the field of Islamic Banking and Finance.

Teaching Methodology:

The teaching methodology will include a combination of lectures, exercises, case studies, in-class assignments, projects, student presentations, group work, and guest speakers. Classes will be taken by our experienced faculty members, senior bankers and finance professionals having long-time experience in Islamic Banking & Finance.

Reasons for selecting PGDIB at UIU

Requirements

Admission Requirements:

Minimum bachelor’s degree from any recognized university /college. However, bankers of both public and private banks will be given preference.

Degree Requirements:

Students must complete all the required courses of the program designed by the university with a minimum of 2.5 CGPA.

Offering Trimester:

Spring, Summer, and Fall.

Teaching Resources:

University professors and experienced professional bankers.

Who this course is for

Islamic Banking and Finance is the new buzzword in the finance world. It is one of the fastest-growing viable sub-sectors in the global financial architecture with strong demand in both Muslim and non-Muslim countries. The Post Graduate Diploma in Islamic Banking & Finance (PGDIBF) aims to impart concise knowledge of Islamic Banking and Finance to individuals related or unrelated to the banking or financial industry with its true meaning and concepts. Islamic Banking is seen as an alternative to conventional banking and a rising sector that brings new opportunities to the local and global finance and banking industry.

PGDIBF jointly offered by IBER of UIU and Chartered Skills is primarily intended to benefit those who wish to pursue a career in Islamic banking & finance and to assist those who are already active in the sector in their ongoing and professional development. The course provides a strong starting point for a unique career in the Islamic Banking industry. To be more specific, professionals in Islamic Banking & Islamic Financial Institution, consultants for Islamic Banking & other related parties will be benefited from this program.

What you’ll learn

The post-graduate diploma in Islamic Banking & Finance (PGDIBF) was designed by IBER of UIU and Chartered Skills with the objective of equipping graduates with Islamic banking and finance concepts to meet the local and global human resource needs and to develop well-equipped professionals with proper knowledge of Islamic financial products and services. PGDIBF would be the ideal diploma program in Bangladesh for those who want a better understanding of the Islamic financial system, values, ethics, and functional frameworks applied in banking and finance. The PGDIBF would also form the foundation of participants who seek to pursue higher studies in Islamic Finance such as MS/Ph.D. programs.

Fee structure of the course:

| Admission Fee | Taka 10,000.00 (Non-Refundable) |

| Tuition Fees | Taka 32,400.00 |

| Admission Form Fee | Taka 500.00 |

| Regular Course Fee | Taka 42,900.00 |

Mode of Payment:

During admission Tk. 15,000.00 + Admission form Tk. 500.00 (Bkash/Online Payment)

Installment 1: Tk. 13,700.00 (before the final exam of Term-I)

Installment 2: Tk. 13,700.00 (before the final exam of Term-II)

Mode of Payment (Special offer):

Special offer for full course single deposit during admission: Tk. 33,180.00

Why Charterd Skills

Chartered Skills is a professional & educational e-learning & hiring platform that provides a wide range of skill-oriented courses helping individuals reach their professional goals. Our platform enables entrepreneurs to learn their industry know-how, helps job seekers match their skill sets with the ideal jobs & allows professionals to remain relevant in their industries through upskilling & microlearning. When you complete a course on Chartered Skills, you become a certified expert through our accreditations.

Along with access to the finest technology & industry experts, Chartered Skills also provides support all the way during & after your course. With access to a personalised dashboard, you will be able to access the courses you have completed, quizzes you have taken and of course, the Certificate of Completion for all completed courses. So start upgrading your skill sets, establish yourself as a leader in your industry and stay relevant in the dynamic ways of the current world, only through Chartered Skills.

Instructors